Key Points:

1. Outsourcing bookkeeping services saves costs by eliminating the need to hire and train in-house staff, and reducing overhead expenses for software and equipment.

2. It enhances efficiency and accuracy with experienced professionals managing tasks, allowing your accounting firm to focus on core activities and growth.

3. Outsourcing offers scalability, flexibility, and access to expertise in areas like tax compliance, while also improving data security and cash flow management.

4. When outsourcing, consider factors like the partner’s experience, security measures, communication policies, and regulatory compliance to ensure a smooth and reliable collaboration.

Accounting firms often encounter a substantial challenge in managing finances, which can swiftly transform into a demanding and time-consuming undertaking. The requirement to balance payroll, invoices, accounts payable, and receivables necessitates attention that could be more effectively employed in delivering superior services to clients. In this article we will discuss in brief about Benefits of Outsourcing Bookkeeping Services.

To enhance efficiency on the financial front of your accounting firm, contemplate the option of outsourcing bookkeeping services to seasoned experts.

These professionals possess the expertise to grasp day-to-day economic trends and are well-versed in optimal practices in bookkeeping.

Outsourcing bookkeeping confers numerous advantages: it has the potential to lead to cost savings, streamline processes, and bestow valuable peace of mind, enabling you to focus on expanding your firm’s brand with an amplified commitment to quality assurance.

Unearth why outsourcing bookkeeping services should claim a paramount spot on your accounting firm’s priority list. Continue reading this blog post to delve into the benefits it brings and how it can contribute to your firm’s triumph and advancement.

The Power of Outsourcing Bookkeeping Services for Accounting Firms

For accounting firms, managing finances can present a significant challenge. The intricate nature of bookkeeping can quickly become overwhelming, especially when trying to handle it internally.

Fortunately, there is a powerful solution that can unlock growth opportunities for your accounting firm: outsourcing bookkeeping services.

By embracing this approach, your firm can free up valuable time and resources, allowing you to concentrate on essential core activities. This, in turn, paves the way for unprecedented growth and success.

Discover how outsourcing bookkeeping services can be the key to unleashing your accounting firm’s true potential. By leveraging the expertise of external bookkeeping professionals, your firm can navigate financial complexities more efficiently and focus on providing exceptional services to your clients.

Don’t miss out on the transformative benefits that outsourcing can offer to your accounting firm.

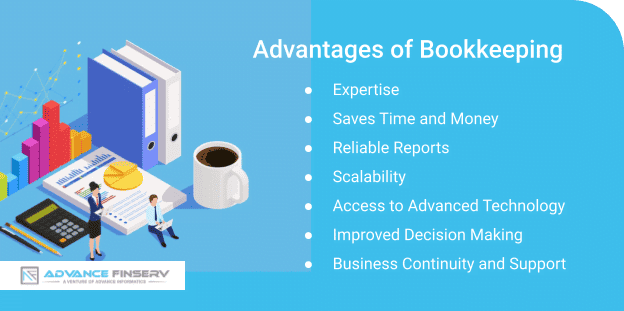

Benefits of Outsourcing Bookkeeping Services

Cost Savings

Outsourcing bookkeeping services for accounting firms can help to reduce costs. By outsourcing bookkeeping tasks, accounting firms can save money on labour costs as they no longer have to hire and train in-house employees.

Additionally, outsourcing bookkeeping services can help to reduce overhead costs as there is no need to purchase or maintain expensive software or equipment.

Increased Efficiency

Outsourcing bookkeeping services can also help to increase the efficiency of an accounting firm. Outsourced bookkeepers are often experienced professionals who have years of experience in their field and are well-versed in the latest technologies and processes.

This means that outsourced bookkeepers are able to complete tasks quickly and accurately, allowing accounting firms to focus on other areas of their business.

Improved Accuracy

Another benefit of outsourcing bookkeeping services for accounting firms is improved accuracy. Outsourced bookkeepers are typically highly trained professionals who specialize in a specific area, such as accounts receivable or accounts payable.

This ensures that all transactions are recorded accurately and all financial reports are up-to-date and accurate.

Access To Expertise

When an accounting firm outsources its bookkeeping services, it gains access to experts with specialized knowledge and skills that may not be available within the firm itself.

For example, outsourced bookkeepers may have expertise in areas such as tax compliance or payroll processing which can be invaluable for an accounting firm’s clients.

Scalability

Outsourcing bookkeeping services also provides scalability for an accounting firm’s operations. If a particular project requires additional resources or manpower, it is easy to scale up the number of outsourced personnel without any disruption to the existing team or workflow process.

This allows an accounting firm to easily adjust its operations according to changing needs without having to invest in additional staff or equipment upfront.

Improved Security

Outsourcing bookkeeping services can also help improve security for an accounting firm’s data and financial information as most third-party providers employ strict security protocols and use secure servers for storing data online.

This ensures that all confidential information remains protected from unauthorized access at all times while still allowing authorized personnel access when needed.

Time Savings

By outsourcing its bookkeeping services, an accounting firm can save considerable time compared with managing these tasks internally.

Outsourced personnel typically have extensive experience in their field which allows them to complete tasks quickly and efficiently, freeing up time for other important projects.

Reduced Risk Of Human Error

Mistakes made by human employees can be costly both financially and reputationally, but outsourcing reduces this risk significantly.

As mentioned earlier, outsourced personnel are experienced professionals who specialize in a specific area, meaning they will be less likely to make mistakes than inexperienced internal staff.

Increased Flexibility

Outsourcing gives an accounting firm increased flexibility when it comes to meeting client demands. If a client needs something done quickly, then extra resources from the third-party provider can be allocated without having to hire new staff members or disrupt existing operations.

Similarly, if a project requires additional manpower at short notice, then this too is achievable through outsourcing.

Improved Cash Flow Management

By outsourcing its bookkeeping services, an accounting firm can improve its cash flow management by streamlining processes such as invoicing clients more efficiently.

This helps ensure that payments are received promptly which helps keep cash reserves healthy while avoiding unnecessary delays due to manual errors or inefficient procedures.

Points to consider before Outsourcing Bookkeeping Services for Accounting Firms

- Understanding Your Needs: Before selecting an outsourcing partner, it’s imperative to grasp your business’s accounting needs. Assess whether you require day-to-day transaction management or more intricate tasks like analyzing financial statements. Additionally, consider your business’s size and the level of support needed from an outsourcing partner.

- Researching Potential Partners: After identifying your accounting needs, initiate research into potential partners. Seek out firms specializing in bookkeeping services and examine their websites for experience and qualifications. Additionally, peruse customer reviews to gauge the quality of service provided.

- Requesting References: While researching potential partners, ensure you solicit references from past clients. This provides insights into their experience working with the company, showcasing their ability to meet deadlines and handle customer service matters.

- Comparing Prices: When selecting an outsourcing partner, comparing prices is essential. Inquire about additional fees and assess providers to determine the optimal value. Take into account potential discounts or incentives that could further reduce costs.

- Evaluating Security Measures: During the partner selection process, evaluating security measures is paramount. Confirm the ability to safeguard sensitive financial information. Inquire about data protection policies, encryption methods, and adherence to regulatory compliance.

- Considering Communication Policies: Effective communication with an outsourcing partner is fundamental. Inquire about communication frequency and methods (email, phone calls). Address potential language barriers proactively to prevent communication challenges.

- Checking Regulatory Compliance: Ensure compliance with relevant regulations such as GDPR or HIPAA. This guarantees the security of data in accordance with applicable laws. Also, verify certifications like ISO 27001, indicating a commitment to global data security standards.

- Exploring Support Services: In addition to security, delve into the support services offered by potential partners. Understand the types of support available (email, phone) and associated costs.

- Assessing Technology Used: Evaluate the technology employed by potential providers. Confirm the use of up-to-date software solutions and inquire about backup systems to minimize disruptions during peak periods.

- Reviewing Contract Terms Carefully: Before finalizing a partnership, meticulously review contract terms. Pay close attention to the agreement’s duration, termination clauses, and payment terms. Additionally, inquire about dispute resolution processes in case challenges arise during the collaboration.

From lower costs to an increased workflow, the benefits of outsourcing bookkeeping services are endless for accounting firms.

With trained professionals running the financial side of your business, mistakes can quickly be fixed and tax return filing is easier than ever. Better yet, human error is minimized, ultimately leading to business growth.

By outsourcing bookkeeping duties, you can ensure that fines or tax penalties don’t happen which saves time and money. Finally, with so much competition in the world today it can be not easy to focus on any one thing—including accounting services.

However, focusing efforts on expanding other branches of your accounting firm may bring more profits overall and help you stay competitive without being bogged down by administrative tasks.

Hope you people found the article on Benefits of Outsourcing Bookkeeping Services informative.For more important and interesting content on Accounting services and taxation services, visit us at advancefinserv.com

Therefore, consider outsourcing your bookkeeping needs for a better solution tailored to fit the needs of your budget and business plan. Looking for bookkeeping services? Fill out the form on the contact page or contact +91 888 777 1848.