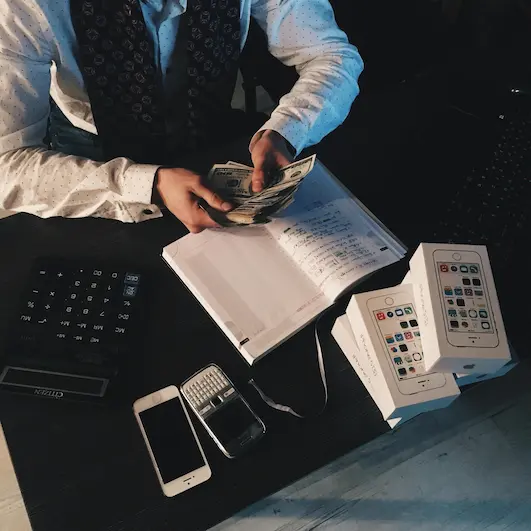

Accounts Payable Services

Simplify your financial workflow with our expert accounts payable services. From invoice processing to vendor management, we ensure smooth operations, fostering stronger supplier relationships and boosting cash flow efficiency

Elevate Management

Amazing Services, Maintained Books

The efficient handling of accounts payable services significantly impacts a business’s financial health and productivity. Through prudent management of outgoing payments, companies can stay attentive to cash flow while building amicable partnerships with suppliers

- Accuracy

- Up-To-Date Data

Organized Productivity

Smooth Accounts Payable Operations

Our organization recognizes that streamlined accounts payable operations aid in maintaining steady liquidity and cultivating mutually beneficial connections with trade partners. As a reputable provider of accounts payable outsourcing solutions across the United States, we offer a full suite of customizable services designed to address the unique requirements of enterprises, both large and small

Pros of accounts payable services

Benefits of Accounts Payable Assistance

Outsourcing accounts payable responsibilities to a dedicated team of professionals unlock a wealth of advantages for enterprises.

Improved Cash Flow

By leveraging the skills of seasoned accounts payable specialists, companies can streamline payment cycles and better manage liquidity. With optimized cash flow, businesses gain enhanced flexibility to direct funds towards strategic priorities such as capital investments, research and development, expanding into new markets, and weathering periods of economic turbulence. A global manufacturing conglomerate increased inventory levels by 10% after engaging external experts to procure more efficient payment processing.

Enhanced Vendor Relationships

Timely reimbursements kept by experienced outsourcers foster goodwill with trading partners. Furthermore, proactive communication between vendors and specialists helps resolve payment inquiries promptly to maintain smooth operations. As a result, companies may experience benefits like priority service, volume discounts and even relaxed payment terms. For example, a leading agricultural firm negotiated preferential delivery schedules after outsourcing accounts payable and demonstrating consistent payment practices to suppliers over several years of collaboration.

Tailored Solutions

Comprehensive Accounts Payable Assistance

At Advance Finserv, we provide a full-fledged suite of accounts payable services tailored to integrate seamlessly with your unique financial operations.

Invoice Processing and Payment Scheduling

Our dedicated team handles all facets of invoice processing from receipt to payment authorization. We carefully review and validate invoices for accuracy and adherence to purchase orders before uploading them into our system. Leveraging customized workflows, we ensure timely yet efficient processing according to your predefined schedules.

This timely processing has helped a leading quick-service restaurant minimize late fees by over 30% in the past year. Additionally, we handle all vendor correspondence and inquiries, from clarifying discrepancies to providing acknowledgement of payment.

Vendor Management and Reconciliation

We maintain prudent management of all your trading partners through our robust Vendor Management System. We liaise with your suppliers, service providers, and contractors to resolve issues proactively.

Our specialists conduct three-way matching and monthly statement reconciliations with vendors, minimizing billing errors to uphold seamless partnerships. A multinational technology manufacturer reduced the average reconciliation time from two weeks to three days by outsourcing vendor management activities to us.

Expense Tracking and Reporting

Our platform facilitates real-time access to critical expenditure insights via personalized dashboards and reports. Featuring advanced analytics and drill-down capabilities, we deliver visibility into department-wise and project-wise spending. This empowers impactful budgeting, forecasting, and cost-control decisions.

A leading nonprofit leveraged our scalable reporting functionalities to simplify the consolidation of expenditure statements from over 50 worldwide chapters into meaningful compliance filings.

Compliance with Regulatory Requirements

Leveraging our expertise in diverse regional statutory norms, we ensure adherence to all applicable financial regulations for your industry and location. From local tax compliance to international trade compliance, our account managers provide updates on changing guidelines and training on-demand.

This safeguards your organization from penalties while promoting financial stewardship. A renowned educational institution outsourced accounts payable compliance to reduce the risk of errors in remitting education cess collected from students.

Why Choose Us for Accounts Payable Services in USA

When outsourcing critical finance functions such as accounts payable, working with a knowledgeable partner is key to unlocking real benefits. At Advance Finserv, we distinguish ourselves in the industry through our dedication to quality and proven track record.

1

Proven Track Record

As a leading provider of specialized accounts payable services for over a decade, we have gained extensive expertise in managing end-to-end invoice processing for companies across sectors. For example, a leading automotive manufacturer witnessed a 25% increase in on-time payment percentage within the first year of working with us—a testament to our ability to analyze client needs meticulously and implement tailored solutions. Our long-standing client relationships are also built on a foundation of consistent delivery as per stringent SLA commitments.

2

Qualified Professionals

Our accounts payable team comprises highly skilled professionals with certifications in bookkeeping, accountancy, and industry-related finance disciplines. Coupled with ongoing training initiatives, this ensures they provide services benchmarked to best practices. Specialists are also assigned based on project requirements – for instance, a healthcare nonprofit was matched with professionals experienced in navigating regulations for their domain. Such calibrated resourcing has helped 96% of clients rate staff expertise and application of industry knowledge as outstanding.

3

Commitment to Excellence

We take immense pride in optimizing back-office workflows and maximizing operational efficiencies through steady process enhancement. Regular performance reviews and client feedback fuel customized solutions that create enduring value. As a result, over 90% of our clients sign up for multi-year engagements, underscoring our dedication towards goals-aligned partnerships for business success. Client references rate our work ethic and focus on harnessing technology for competitive advantage as top differentiators in outsourcing choices.

Connect with us

Ready to streamline your accounts payable processes and optimize your financial operations? Contact us to discuss customized solutions to optimize your processes. Our customized consultations identify areas of inefficiency and deploy techniques empowering data-driven decisions, ensuring funds maximize stakeholder value through prudent allocation channeled towards objectives like innovation.